Key takeaways The Federal Reserve doesn’t directly set auto loan rates — but it does affect the cost for lenders to borrow money. The Federal funds rate was cut for a third and final time in 2025 and was not changed in the first meeting of 2026, so it currently…

The Federal Reserve made no changes in its January 2026 meeting, keeping the target rate at 3.50-3.75%. The end of 2024 and through 2025 stabilized auto loan rates, and Bankrate experts predict auto loan rates are unlikely to shift much through 2026. Car prices have increased, and inventory shortages have…

Sixty percent of Americans under age 65 — that’s about 164.7 million people — receive their health insurance through their employer, according to a Kaiser Family Foundation analysis. That means losing a job can feel like a one-two punch: the loss of both income and health insurance. Then comes the…

Would you be upset if you found out your partner had a credit card you didn’t know about? On the flip side, have you ever fudged the numbers with your spouse about a recent shopping spree? Romantic relationships can come with mixed feelings about money. That’s why we asked more…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Thomas Barwick / GettyImages Each month on Rent Day — the first of every month — Bilt delivers a new set of bonus opportunities for cardholders and members. Offers range from earning bonus points to exclusive experiences just for members. In celebration of February Rent…

Dept Managmnt

2. Coaching and Tutoring Take stock of your areas of expertise – maybe you speak a second language or solving math equations comes…

Banking

OBSERVATIONS FROM THE FINTECH SNARK TANKBankers wants to discuss AI strategy. They’re excited about chatbots, machine learning models, generative AI tools, and AI…

Credit Cards

All News

Westend61/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways FHA 203(k) loans provide funding to finance both a home’s purchase and the cost of repairing it. This type of loan, which you can obtain from an FHA-approved lender, is reserved for borrowers who intend to live in the home, not house-flippers or…

Key takeaways If your annual income is less than the standard deduction, you likely aren’t required to file a tax return. But exceptions apply to self-employed people, taxpayers who file as married filing separately and others. The standard deduction for the 2025 tax year, for tax returns filed in 2026,…

Tax credits are a powerful way to save money on taxes. Each dollar of a tax credit is subtracted directly from the amount of tax you owe the IRS. And some tax credits are refundable, meaning even if you don’t owe any tax, the credit is paid out to you…

Key takeaways Investing in an S&P 500 index fund is an easy way to get instant exposure to hundreds of the largest companies in the U.S. in one investment vehicle. All S&P 500 funds are fundamentally invested in the same stocks, so choosing the “cheapest” one (the one with the…

Key takeaways Your homeowners insurance premium may increase after a successful claim. The severity of the claim can impact the amount of the increase. Looking for discounts and shopping around are two ways to keep your rate reasonable. You’ve probably heard that your insurance can go up if you file…

Whether you can claim an adult child as a dependent on your taxes depends on their age, income and living situation, as well as the level of financial support you provide to them. The IRS allows parents to claim certain adult children if they meet the criteria for either a…

With interest rates somewhat in flux, savers and investors might have to search a little bit harder to find the best returns from relatively safe investments such as money market funds. Money market funds invest in short-term securities issued by governments and corporations and are available from several different brokers…

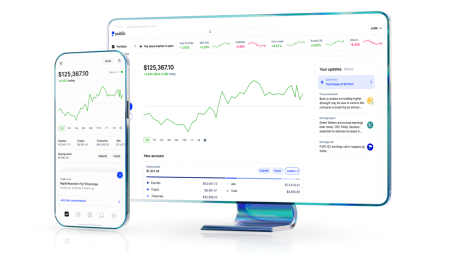

Public is an investing platform that offers a solid trading experience, free trades on stocks and ETFs, easy access to bonds — and options traders will enjoy getting money back on their trades through Public’s rebate program. Other key features include: Fractional shares, so you can trade with as little…

A nursing home cannot directly seize funds held in an individual retirement account (IRA). However, retirement accounts in many states are generally treated as countable assets for Medicaid eligibility, which means their value can affect whether you qualify for Medicaid coverage of long-term care. In many cases, this requires a…

Capital gains are the profit you earn when you sell an asset like a home, business or stocks. Those gains are subject to capital-gains taxes, but capital gains are taxed differently depending on the type of asset — and how long you owned the asset. That’s because, while the federal…